- Email:

- Bryan@WaserGroup.com

- Phone:

- 972-743-6337

Financing Options

Financing Options

1. FHA – These loans require 3.5% down payment as well as mortgage insurance premium (MIP*). MIP payment is 1.75% of the loan amount at closing plus .55% annually. On a loan of $350K, that would be about $6000 at closing and about $150/mo. FHA loans are a bit more forgiving on credit scores and debt to income ratios.

2. Conventional – These require 5-20% down. Anything under 20% down will require private mortgage insurance (PMI).

3. Veteran Administration (VA) – Exclusively for veterans. $0 down and no mortgage insurance premium.

4. Jumbo – Loans over $766,550. They will generally have a higher rate than conventional loans.

Lacking down payment money?

There are four different options.

1. If you’re a veteran, one of your benefits is $0 down loans for your primary home purchase and no private mortgage insurance (PMI).*

2. If the property is in a qualifying rural area and you qualify, $0 down can work for you. To check if a property qualifies, visit

https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do and enter the address you’re considering.

3. Down payment assistance programs. These programs generally have income limits and are offered at a higher than market rate since the buyer isn’t putting any money down and the banks view that as higher risk. We have a great contact for this program. Lori Lee with Planet Home Lending at 214-215-5213 or Lori.Lee@PlanetHomeLending.com

4. $0 Down Program through a specific bank. Banks are required to reinvest a portion of their profits back into the communities. This program is unique because there is no PMI and the interest rates are competitive. Properties must meet specific criteria as far as diversity in the area. Contact Bryan Waser at 972-743-6337 for details on this program.

Looking for the best rate?

We have a variety of builders who are offering homes with 5.5% FHA rates on homes that should be completed in the next 90 days. Let us know what areas you’re considering and we can provide specific builder options.

Other than that, it’s best to get a pre-approval about 60 days before you plan to close. Then, we can shop in the appropriate price range and present weekend offers since we would need the pre-approval letter to send with the offer.

Regardless of the program chosen, you’ll need to have credit scores in the 600’s or higher, around 1% of the purchase price to be used for earnest money, $500 for appraisal, and $500 for inspections. That is all that would be needed prior to closing day.

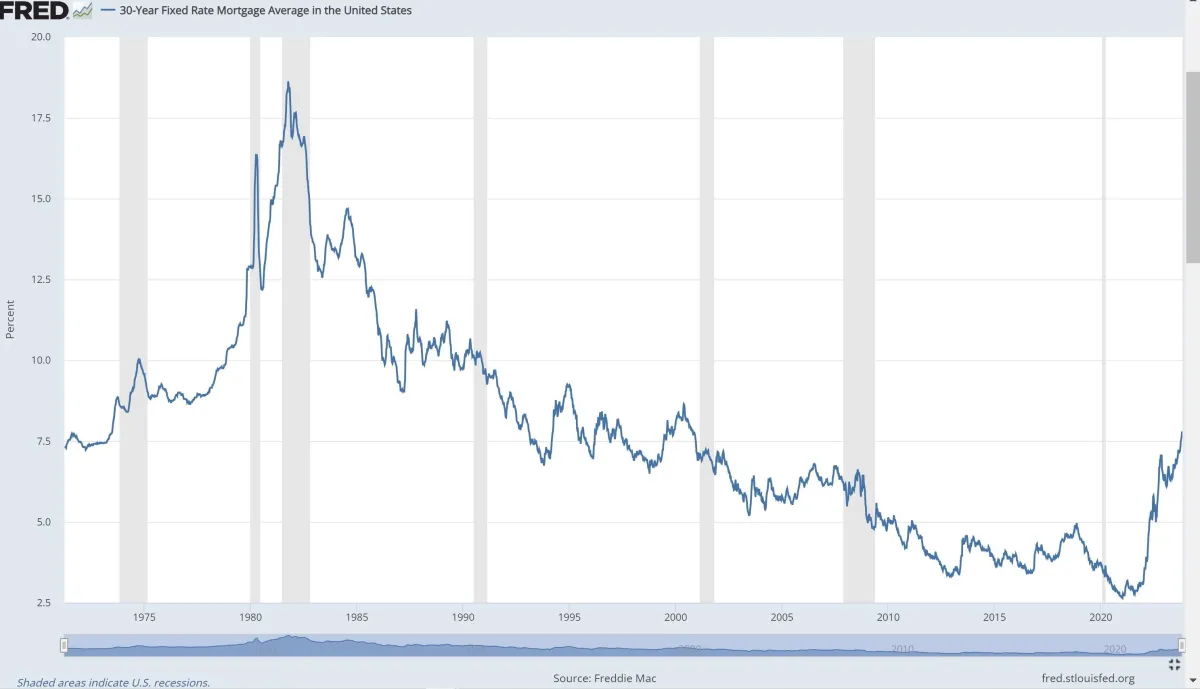

It would be a mistake to wait for rates to come down much. Once rates drop to 6% or so, I expect multiple offers to start showing up again. Then, we’ll likely be seeing people bidding 5-10% over list price. It is better advised to buy before losing another year of appreciation and then refinance if/when rates come back down. That said, I wouldn’t hold my breath for 3% rates to come back. Too much money was printed during Covid 19 days, which caused inflation. Additionally, the Fed intentionally wanted rates higher in order to slow down the housing market. See chart below on the history of rates since 1970. Grey shaded areas were recessions.

* Private mortgage insurance is required on loans where the borrower has a down payment under 20%. The lender is made whole if the borrower defaults on the loan.

Copyright © 2023 Real Estate. All rights reserved